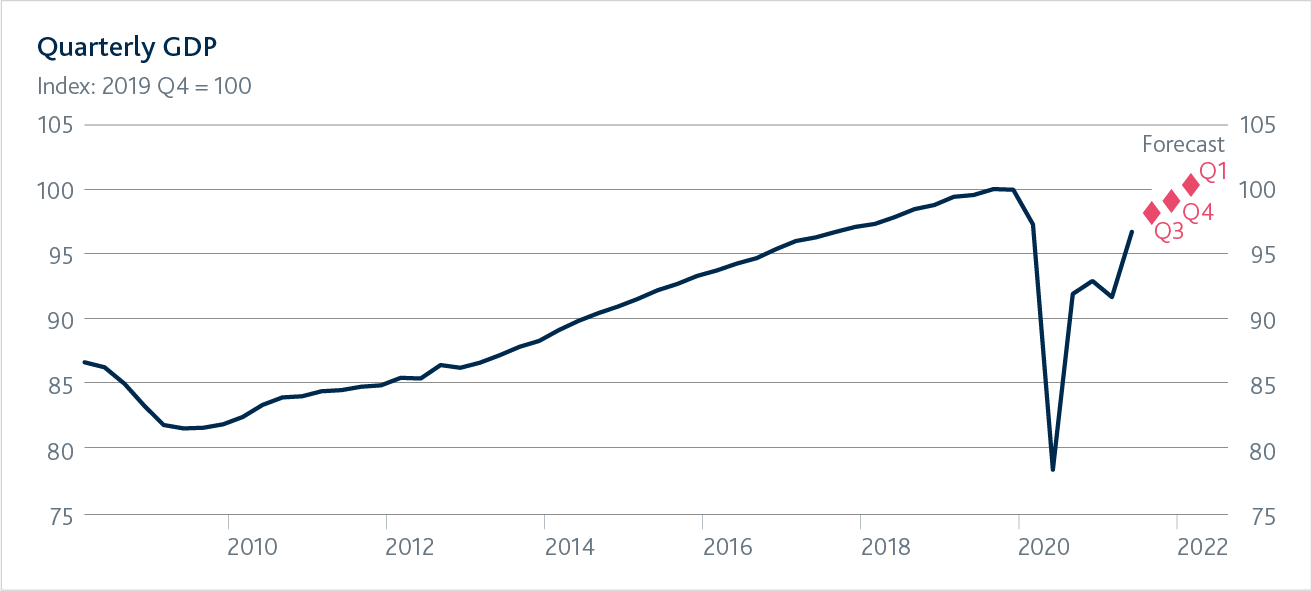

Spending, jobs and incomes have continued to recover from the effects of Covid. The size of the UK economy is getting close to where it was before the pandemic. Unemployment has fallen, although it is higher than it was before the pandemic.

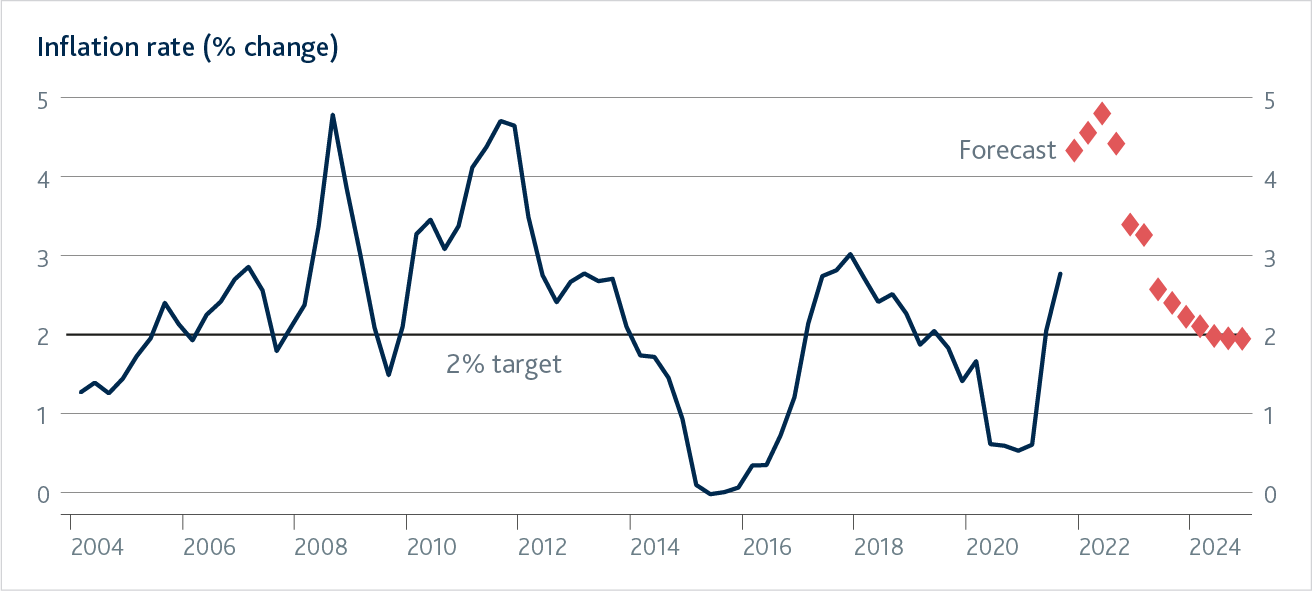

(the pace of price rises) has risen above our 2% target. Prices rose by 3.1% between September last year, when prices were low because of Covid, and September this year.

Inflation has risen in many countries. As economies reopened, demand for some goods increased sharply. Some businesses have struggled to meet this extra demand, held back by, for example, shortages of materials and workers. That pushes up costs and prices. Energy prices have also risen, pushing up inflation.

These effects are likely to continue pushing inflation up in the coming months. We expect inflation to rise to around 5% in the spring next year. We expect these high rates of inflation to be temporary. We don’t think that demand will continue to rise as fast, and many of the shortages that are currently making it difficult for businesses to produce their products should ease.

We expect inflation to fall back from the middle of next year, and to be close to our target in two years’ time.

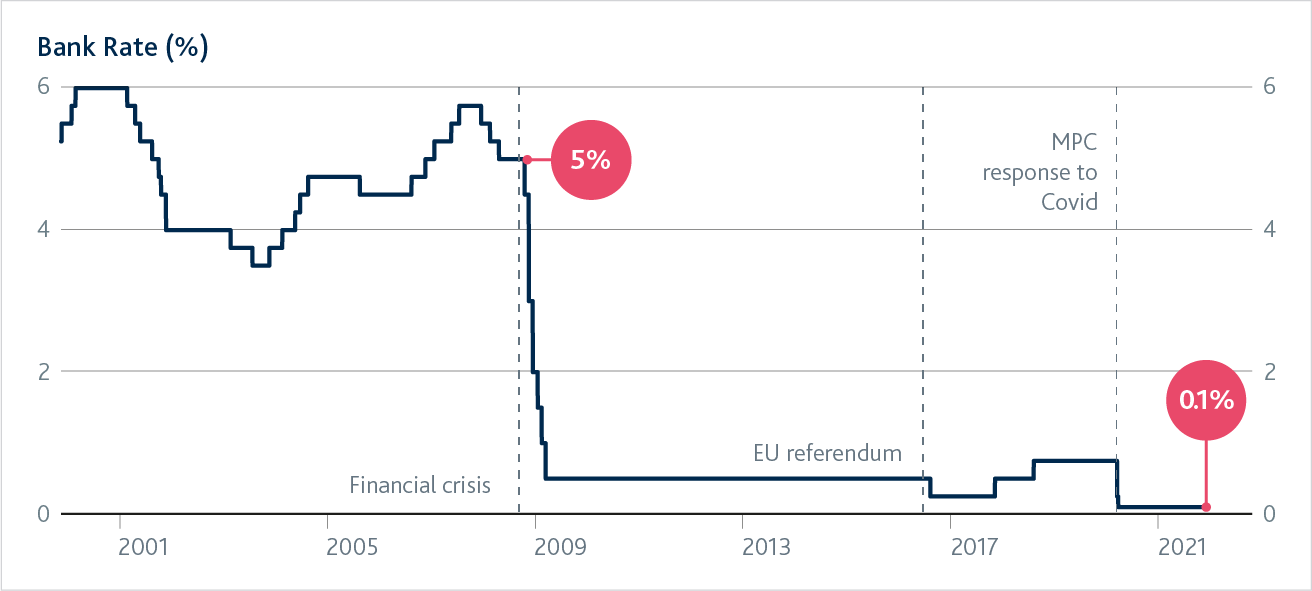

Our job is to ensure that inflation returns to our target sustainably. In response to the Covid pandemic, we have been supporting households and businesses by setting low and through quantitative easing. This keeps the cost of borrowing low.

We expect interest rates will need to rise modestly to return inflation to our 2% target.

The UK economy continues to recover from Covid

As more people have been vaccinated, restrictions to control the spread of the virus have been lifted in a number of countries around the world.

The UK economy is recovering from the impact of Covid.

We have seen a rise in spending by households and businesses. Unemployment has fallen, although the number of people out of work is still higher than it was before the pandemic.

Overall, the size of the UK economy is getting close to where it was before the pandemic hit.

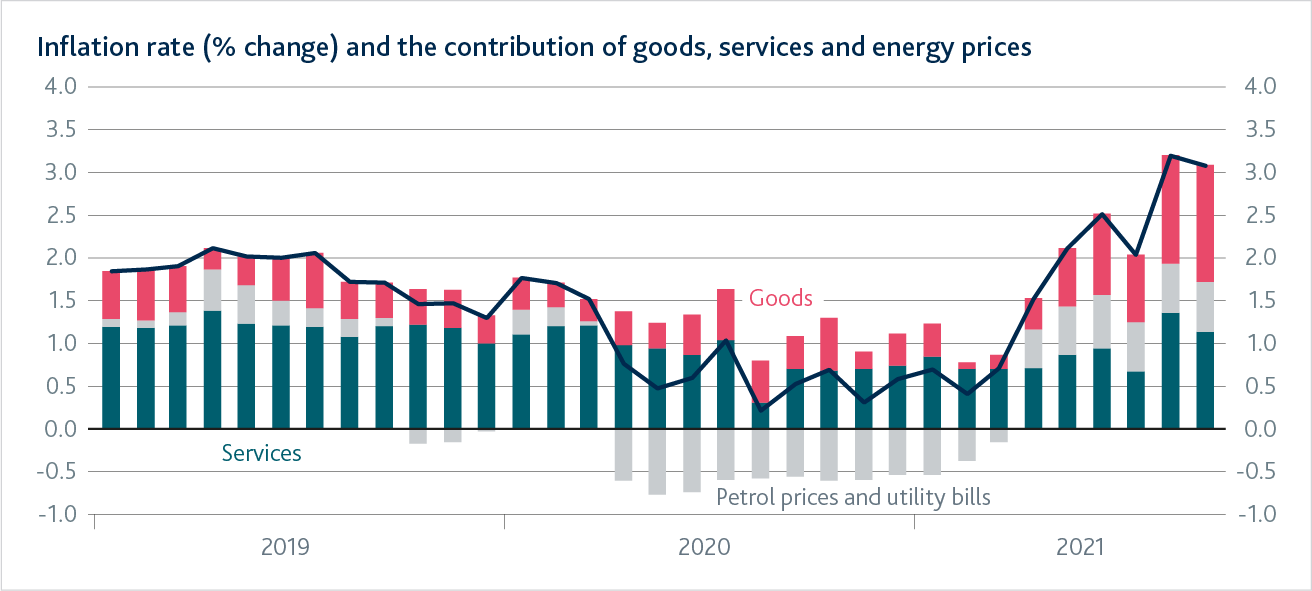

Higher energy and goods prices have pushed inflation above our 2% target.

The prices of the things people typically buy increased by 3.1% between September last year, when prices were low because of Covid, and September this year.

This means inflation is above our 2% target.

Some of the increase was caused by a rise in oil and gas prices. That put the cost of petrol and up.

As Covid restrictions have been eased in many countries, there has also been a big increase in how much people want to spend.

That was particularly the case for certain goods, the increase was less sharp for many services.

Some businesses have struggled to meet this extra demand, held back by, for example, shortages of materials and workers. This is pushing up prices.

We expect inflation to rise to around 5% in the spring, but then fall back

We expect inflation to rise further to around 5% in the spring next year.

After that, we expect inflation to fall.

One reason for that is that we think the impact of higher oil and gas prices will fade.

We also don’t think that the demand for goods will continue to rise as fast.

And we expect that some of the production difficulties businesses are facing will ease.

We expect inflation will be close to our target in around two years’ time.

We expect interest rates will need to rise modestly to return inflation to our 2% target

When the Covid pandemic struck, we needed to take immediate and substantial action to meet our inflation target.

That action included a cut in interest rates to 0.1% in March 2020.

The outlook has now changed.

The UK economy is recovering, unemployment has fallen, and we expect inflation to rise further to around 5% by spring next year.

We now expect interest rates will need to rise modestly to return inflation to our 2% target.

By making sure that inflation returns to target we are continuing to support people’s jobs and incomes, and helping the UK economy grow.

Press conference

Related documents

- Monetary Policy Report - November 2021 (PDF 5.4MB)

- Monetary Policy Report chart slides and data - November 2021 (ZIP 14.7MB)

- Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 2 November 2021 (PDF 0.4MB)

- Andrew Bailey's opening remarks at the Monetary Policy Report Press Conference - November 2021 (PDF 0.5MB)

- Monetary Policy Report Press Conference transcript (PDF 0.2MB)